Context

Insurance is one of the oldest financial tools in history, but has seen only limited adoption in the crypto ecosystem. Notable examples include Nexus Mutual and Chainproof.

We are now entering a phase where traditional finance is increasingly moving onchain. At the same time, more sophisticated infrastructure is enabling new financial use cases, such as identity or reputation-based undercollateralized lending. In parallel, the rise of restaking has introduced new primitives for building permissionless, fully automated onchain risk transfer products by leveraging slashing and redistribution mechanics. A notable early adopter of this model is Cap Labs.

Symbiotic’s flexible vault infrastructure is already in use by some of the most advanced risk management entities in crypto, including Gauntlet, RE7, MEV Capital, and others. well-positioned to support a wide range of custom risk-related products.

This post outlines the core insurance primitives and explores how Symbiotic’s universal staking modules can be used to build custom, programmatic risk solutions.

Matching Insurance to Symbiotic Primitives

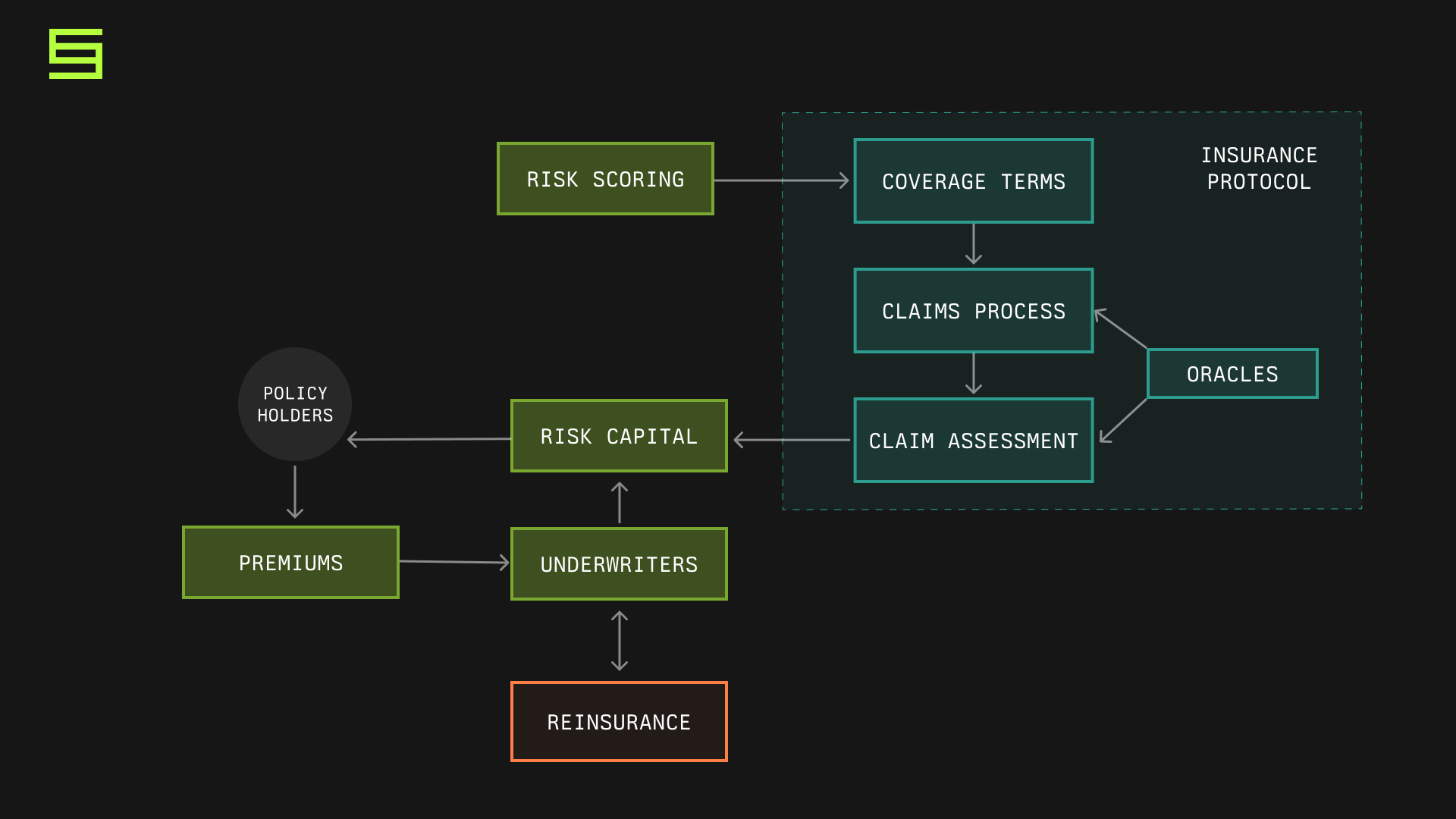

At a high level, insurance generally involves three core participants:

- the insurance protocol (or policy), which defines the coverage terms, including how claims are triggered and assessed

- underwriters, who provide collateral in exchange for yield from premiums

- policyholders, who pay premiums in exchange for coverage

An insurance system begins with capital. Underwriters provide funds into risk pools, expecting to earn yield from the premiums paid by policyholders. These pools serve as the financial base, ready to cover claims when insured events occur.

Policyholders enter the system by paying premiums in exchange for protection. Premiums can be paid upfront, streamed over time, or pulled directly from locked collateral.

To align capital with risk, scoring models evaluate the likelihood and severity of loss events. These models guide pricing and determine which risks underwriters are willing to accept.

Once pricing is established, coverage terms define what is protected, what events qualify for claims, and what is excluded. These terms can be enforced through smart contracts, legal agreements, or governed systems.

When a covered event happens, the claims process defines how policyholders submit claims or how claims are automatically triggered based on external conditions.

Claim assessment follows. This is where resolvers, committees, or automated systems evaluate if a claim is valid and eligible for payout from the pool.

Oracles provide the data that powers this flow. They monitor events both onchain and offchain, such as protocol exploits or asset price deviations, to help confirm whether coverage conditions have been met.

To strengthen the system, reinsurance covers the capital pools themselves. This spreads exposure across different risks or protocols, adding a layer of protection against large-scale losses.

Applications: Underwriting Bad Debt Events in Lending Markets

One of the most direct and high-impact applications of onchain insurance is underwriting bad debt in lending protocols. As DeFi markets mature, the risk of protocol insolvency due to sudden price crashes, depegs, or technical failures remains ever-present. Historical examples across MakerDAO, Venus, Aave and Scream show that even the most robust systems can suffer multi-million dollar shortfalls in extreme scenarios. These bad debt events not only damage user confidence but often require emergency governance actions, treasury bailouts, or token holder dilution. Insurance presents a systematic alternative.

By underwriting specific risk events such as collateral price crashes, stablecoin depegs, or LST volatility, insurers can absorb these losses and protect lenders. Protocols pay a premium to transfer the tail risk of insolvency to specialized capital pools. In return, depositors gain stronger guarantees of repayment, and protocols avoid the need to tap reserves or issue emergency tokens.

This protection extends beyond volatile assets. Stablecoin collateral, if depegged, can turn entire markets insolvent. A 20 percent drop in a major stable’s price can result in $50 to $130 million of unbacked loans. Similarly, a 25 percent depeg in liquid staking tokens can wipe out collateral and generate over $100 million in bad debt. These are precisely the kinds of tail risks that insurance can neutralize. Rather than rely on community bailouts, protocols could allocate a portion of yield to continuously pay for insurance and shift the risk onto dedicated underwriters.

Insurance transforms the risk profile of lending markets. What used to be catastrophic loss becomes a reimbursable event. Protocols gain resilience. Lenders gain trust. And underwriters gain yield from pricing and absorbing these events. This is not just a defensive mechanism, but a foundation for scalable, dependable lending in DeFi.

Symbiotic is extending its architecture beyond traditional shared security into new verticals where insurance unlock entirely new protocol designs. By giving builders the ability to enforce commitments with real collateral and programmable slashing, Symbiotic enables use cases that were previously impossible or too risky to deploy.

As we continue exploring and expanding Symbiotic's capabilities, we invite the community to get involved. Whether you're a network builder, an operator, or simply an enthusiast interested in the future of shared security, there's a place for you. If you are interested in learning more or collaborating with Symbiotic, reach out to us here.