Introduction

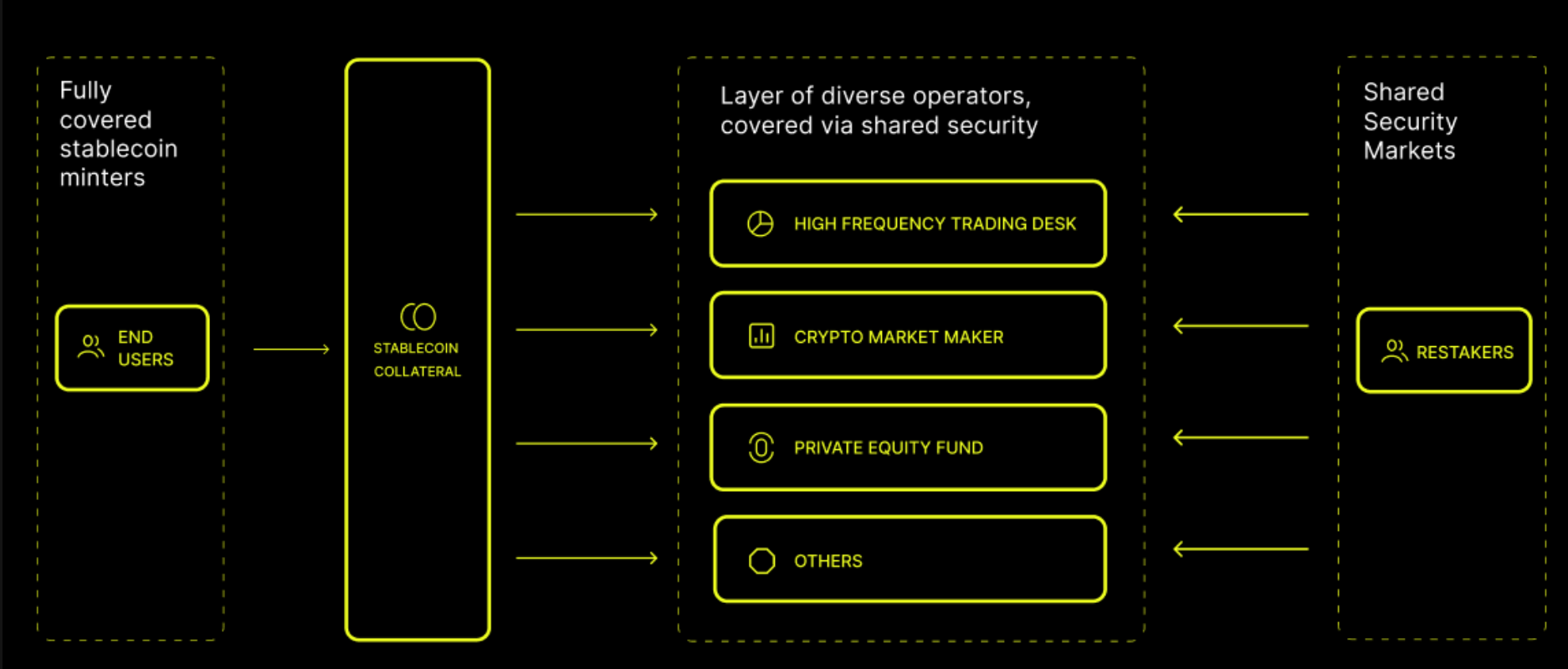

Cap is a decentralized stablecoin protocol that separates yield generation from risk by using a modular operator layer. Instead of a DAO or treasury generating yield for stablecoin holders, independent agents borrow funds and deploy them into yield strategies, such as arbitrage, market making, or RWAs. These agents aren’t trusted by default, as they must first secure a guarantee from external stakers who lock up capital as a form of performance bond. This structure allows Cap to scale yield strategies across any asset class or market condition while keeping the protocol itself lean and risk isolated.

The key innovation in Cap is that stablecoin holders are fully protected from yield-related losses. If an operator fails to return the borrowed capital, whether due to strategy underperformance, default, or fraud, the stakers who backed that agent are slashed. The slashed funds are redistributed to cover the shortfall, ensuring the stablecoin remains fully collateralized. In this model, agents and stakers operate in a permissionless market where agents post their strategies, stakers assess risk and choose who to back, and rewards flow to stakers and stablecoin holders.

This creates a clean separation of roles where stablecoin users get passive competitive yield, agents compete to access liquidity, stakers take on risk in exchange for upside, and Cap coordinates the system through smart contracts without discretionary governance or insurance committees. The result is a trustless, modular stablecoin architecture where risk is underwritten by the market, rather than being absorbed by users. Cap is not a single coin but an engine to create multiple yield-bearing stablecoins, each protected by programmable economic guarantees.

Universal Staking Overview

Universal Staking is more than just staking. Instead of merely reusing staked assets to secure multiple networks, it introduces a flexible coordination layer for sharing collateral across a wide range of use cases beyond Proof-of-Stake (PoS) implementations.

Through engaging with hundreds of builders over the last few months and launching 14 networks on mainnet, Symbiotic realized that the underlying concept of shared security can be leveraged in ways far beyond what staking and traditional shared security infrastructure envisioned. What started as a way to coordinate stakers and networks around Proof-of-Stake security revealed a broader design space for incentive alignment and capital coordination.

Universal Staking, as developed through Symbiotic, builds on this insight. It generalizes the shared security model into a modular coordination layer that can be applied across use cases, not just for securing consensus, but also for underwriting risk, bootstrapping new protocols, and aligning incentives between diverse actors. For example, lending markets can use it to backstop bad debt, enabling stakers to opt into specific risk profiles with customizable terms. This is no longer just about securing networks, but about unlocking new forms of programmable trust between capital and applications.

For more details about Universal Staking, please refer to our recent Universal Staking blog post.

Guarantees

Contextual Overview

In a universal staking system, guarantees refer to commitments backed by staked collateral that certain outcomes or performance criteria will be met. If not, the collateral can be slashed (burnt or redistributed) as a penalty. Designing such guarantee mechanisms raises several important considerations:

Delegation Model: How are risks underwritten and distributed?

In Cap’s design, risk guarantees are underwritten on a per operator basis rather than pooled globally. Each yield generating operator must secure sufficient staked collateral from stakers before they can draw user funds to deploy. The amount stakers delegate to a given operator directly limits how much of the stablecoin collateral pool that operator is allowed to borrow, ensuring that any potential losses are covered by that operator’s specific backing. This isolates slashing risk to individual operators or strategies. If one operator fails, only the stake backing that operator is slashed rather than causing a protocol wide impact. Furthermore, Cap’s implementation avoids co-mingling stakes across unrelated networks. staked assets dedicated to Cap are not simultaneously securing other protocols, preventing correlated failures from multiple networks competing for the same collateral. By confining each staking vault to Cap’s own operators, the system contains risk within the Cap network and shields it from external slashing events.

Reward Attribution

The distribution of rewards in the Cap guarantee system reflects each operator’s performance while providing predictable yields to stakeholders ex ante. Stablecoin holders, who mint cUSD, earn a benchmark yield set by the protocol, a competitive rate that is promised irrespective of any single operator’s outcome. This yield is essentially guaranteed to users upfront, funded by the success of operators and the insurance provided by stakers. Operators, for their part, receive borrowed stablecoin liquidity without upfront capital requirements, but are obligated to return at least the benchmark yield plus a premium to stakers — under penalty of slashing if they fail to meet terms. If an operator’s strategy outperforms the benchmark, the excess return is kept by the operator as profit after paying users, stakers, and the platform. On the other hand, if an operator underperforms or incurs losses, the system’s guarantees ensure that stablecoin holders still receive their due yield or at least protection of principal. Any shortfall is covered by slashing the staked collateral. In this way, rewards to users and stakers are determined ex ante as a fixed yield and premium, whereas the operator’s net payoff is determined ex post by actual performance relative to these commitments.

Slashing Logic

Cap employs deterministic and task-specific slashing conditions that are transparently encoded as part of the protocol’s rules. Slashing is triggered by verifiable events tied to an operator’s performance, rather than arbitrary or external incidents. In particular, two objective fault conditions are enforced. The first is failure to return the full amount expected, whether that means principal or yield. The second is insufficient active delegation or coverage for an ongoing operation. These conditions are monitored on chain, so that any breach automatically results in a slashing action. Because the triggers are tied to the operator’s specific performance, a slashing event only impacts the collateral delegated to that operator. There are no global protocol-wide slashing events unrelated to operator behavior. Even market-wide downturns or force major events only result in slashing if they directly cause an operator to default.

The determinism and observability of Cap’s slashing logic are critical for staker confidence. All parties are aware of the exact conditions under which slashing occurs, which minimizes ambiguity and avoids discretionary enforcement. This structure contrasts with traditional insurance models, where payouts often require governance votes, subjective claim reviews, or case-by-case assessments. In Cap, if an operator fails to meet an agreed-upon objective criterion, slashing and redistribution of funds happen through smart contracts. This provides stablecoin holders with assurance that failures are handled swiftly and reliably, without delays or trust assumptions.

Pricing and Market Dynamics

In CAP, premium rates are determined between operators and delegators on a pair-by-pair basis. Each operator negotiates a fixed premium with their stakers, which is paid at the end of the loan term alongside the benchmark yield, paid to the stablecoin holders. The benchmark yield itself is derived from the aggregate borrowing behavior and adjusts to reflect overall demand for capital in the system.

For example, if the benchmark yield is 13 percent and a staker premium of 2 percent is agreed upon, an operator generating a 40 percent return would retain the remaining 25 percent as profit. This structure allows operators to set competitive terms with stakers, while still providing clear expectations around capital cost.

CAP does not rely on automated premium discovery tools such as bonding curves or auctions. Instead, it enables bilateral pricing while letting the benchmark adjust based on macroeconomic factors and borrowing pressure. This flexibility supports competitive yet stable returns, allowing users to earn consistent yield without chasing incentives across protocols. Since slashing guarantees the benchmark yield, stakers are protected against operator failure. This predictability strengthens trust in CAP’s stablecoin and supports long-term demand.

Subset Selection

Cap gives stakers the ability to choose exactly which operators or strategy types they want to back. This opt in structure means stakers can shape their own risk exposure, rather than being forced to underwrite the entire network indiscriminately. A staker who trusts a specific operator can allocate their entire stake there, while another may spread their delegation across several agents to diversify risk. This flexibility encourages stakers to perform due diligence, monitor operator performance, and allocate based on real preferences rather than default settings.

The result is a decentralized risk selection layer embedded within the protocol. Delegation becomes a signal of confidence. Good operators naturally attract more delegation at lower premiums, while riskier ones either pay more or fail to raise enough to be active. This market-based filtration improves protocol safety and capital efficiency. Symbiotic vaults enable this delegation structure to be programmable. Some vaults can aggregate many stakers and distribute delegation across multiple operators for diversification, while others may be dedicated to single operator strategies for higher conviction staking. Cap chooses to isolate its vaults within the Cap network alone, rather than sharing risk exposure across protocols. This prevents correlated slashing and keeps Cap’s guarantees cleanly scoped to its own stablecoin engine.

Stakers therefore manage their exposure precisely and take responsibility for their choices. If they back a strong operator, they earn yield. If they back a failing one, they are slashed. Because stakers can opt in and out as they please, and because the protocol’s slashing rules are deterministic, the entire system aligns risk, incentive, and accountability in a transparent and modular way.

Insurance versus Guarantees

Traditional crypto insurance mechanisms differ fundamentally from Cap’s native guarantee system in both structure and execution. In conventional insurance models, such as slashing protection services or stablecoin depeg insurance, coverage is offered as an external product that users or validators must purchase separately. An insurer, whether structured as a decentralized mutual or as an underwriter, collects premiums and promises to compensate losses if a certain adverse event occurs. This form of insurance is usually optional and sits on top of a base protocol that itself does not enforce loss recovery. For example, a validator might buy slashing insurance from a third party so that if they are penalized on a proof of stake network, the insurer reimburses a portion of the lost stake. Similarly, a stablecoin holder might purchase depeg coverage that pays out if the stablecoin trades below its peg for a specific period. These policies typically involve actuarial pricing, premium payments by users, and a claims process.

Cap’s guarantee system is not an external layer but an integrated feature of the protocol itself. Every yield generating activity in Cap is fully collateralized and underwritten through its native staking mechanism. When a user mints stablecoins and stakes them for yield, the funds are not allocated to strategies unless they are guaranteed by sufficient staked collateral from external stakers. These stakers effectively act as insurers, locking assets that can be slashed if the operator they back fails to return the funds or generate the promised yield. Because the collateral is in place before any funds move, and because enforcement is handled by protocol logic rather than governance or claims, users are protected by default. They do not need to opt into coverage or assess individual policies. The moment an operator defaults, the staked collateral is slashed and redistributed to cover the loss.

Unlike insurance, where the issuer absorbs the loss, Cap’s model allows delegators to retain a right to be repaid by the operator that caused the default, via offchain legal agreements. This lowers the risk to delegators and ensures slashing is not an unrecoverable loss. From the user’s perspective, this is a real-time guarantee that the capital is safe, and the promised yield is insulated from execution risk.

Another important distinction concerns how each system handles payouts and risk limits. Traditional insurers pool capital and price policies based on historical probabilities, knowing that not all claims will be triggered simultaneously. In contrast, Cap’s guarantee model is over collateralized and specifically tied to individual operators. This ensures that even large losses can be absorbed in full. There is no risk of insurer insolvency or an overwhelmed claims fund, because losses are pre funded and linked directly to performance. This structure also prevents contagion across the system. If one operator fails, the slashed funds come only from the stake assigned to that operator, not from a shared insurance pool or treasury. That keeps the rest of the system intact and makes coverage predictable and enforceable.

Finally, Cap’s model strengthens alignment between all actors: stakers, unlike traditional insurers, have direct capital at risk and earn yield only when operators succeed. If they choose to back risky strategies or negligent agents, they face economic loss. This creates strong incentives for thorough due diligence and prudent capital allocation, while driving stakers to demand higher premiums. Users are guaranteed protection not by relying on discretionary trust in an insurance provider but by the protocol’s enforcement of hard collateral rules. Cap effectively eliminates the need for opt in DeFi insurance products and replaces them with embedded, automated guarantees enforced through Symbiotic’s vault infrastructure. The result is a more secure, efficient, and transparent way to manage execution risk and ensure user protection in yield bearing stablecoins.

Guarantee Markets on Symbiotic

In the Cap system, stakers provide the underlying economic guarantees that secure yield strategies executed by external operators. These stakers, who are institutional staking providers, perform due diligence and choose which operators they are willing to underwrite. Their institutional status allows them to enter into legal bindings with operators for recourse provision. In exchange for posting capital and assuming slashing risk, they earn a yield premium paid by the operator. Operators are typically sophisticated entities such as market makers, RWA firms, or arbitrage desks, and they must opt in to Cap’s conditions in order to draw funds from the stablecoin’s collateral pool. The Symbiotic vault architecture ties these two roles together. Operators can only utilize capital when properly collateralized, and if they fail to perform, the Cap slashing mechanism implemented through Symbiotic slashes the delegated collateral to protect users and maintain system stability. This creates a seamless flow of value and responsibility between stakers, operators, and the Cap network with strict enforcement guarantees.

At a technical level, the Symbiotic integration allows Cap to configure dedicated vaults for each collateral type. These vaults act as bridges between Cap’s stablecoin protocol, the operators executing strategies, and the stakers backing them. It accepts specific types of collateral from stakers, enforces Cap’s slashing conditions, and authorizes operator withdrawals only when the required coverage is active. When a staker deposits collateral into the vault, they implicitly agree to the slashing terms Cap defines. Meanwhile, Cap’s stablecoin contracts check with the vault before releasing funds to operators. In effect, the vault serves as an on-chain enforcement layer and escrow system, linking operator access to verifiable backing and ensuring that users never bear the execution risk. It manages staker balances, risk attribution, and fault resolution, forming the core infrastructure for the Cap guarantee economy.

Slashing in the Cap vault is enforced through Symbiotic’s native slashing modules, which can be configured as the basic Slasher. Because slashing conditions are autonomous, there is no need for governance in slashing. the network middleware, in this case Cap’s smart contract, is responsible for initiating slashing requests. The Slasher module executes the penalty upon request if the conditions are met, offering a simple and programmable enforcement model. This is suited for cases where slashing conditions are deterministic and observable on chain, such as repayment failures or missed yield thresholds.

In both systems, any liquidator may permissionlessly trigger a slash via Cap’s middleware. Enforcement logic is configured at the vault level based on which Slasher type is selected during deployment. This gives stakers full transparency into the slashing process when deciding to delegate. Once a failure condition is triggered and the request passes validation, the protocol slashes the associated stake and reallocates the funds. Typically, this means transferring stake assets to the liquidator who purchases the stake at a discounted price with the borrowed asset. The borrowed assets are then atomically transferred back to the stablecoin reserves to restore one to one backing and prevent any user loss. The system requires no governance votes or discretionary approvals. Execution is automatic, bounded by the vault’s configuration, and driven entirely by the middleware’s inputs.

This model enables Cap to issue stablecoins backed by real yield strategies, without exposing users to downside. Every operator is paired with staker coverage, every risk is accounted for in advance, and every failure is resolved automatically. Through Symbiotic, Cap runs a continuous guarantee market where operators compete for backing, stakers price risk, and users benefit from a fully shielded, yield-bearing stablecoin experience.

Real-World Parallels (Symbiotic Guarantees vs. Surety Bonds)

Symbiotic’s guarantee model, as implemented in Cap’s design, closely parallels the structure of a traditional surety bond or performance bond in finance. A performance bond typically involves three parties. The principal is the party expected to fulfill an obligation, the obligee is the beneficiary who expects the task to be completed, and the surety is the guarantor who promises to pay the obligee if the principal fails. In Cap, the operator plays the role of the principal, responsible for executing yield strategies and returning funds. The stablecoin holders or the protocol on their behalf are the beneficiaries. The stakers function as the surety by posting collateral that gets slashed if the operator fails. Their staked ETH acts as a bond that guarantees performance. Just as in traditional surety arrangements, this structure aligns incentives. Operators need to secure backing from third parties and are discouraged from failing, while stakers must carefully vet and price the risks they are underwriting.

The similarities extend to how stakers assess operators, much like surety companies underwrite contractors. Stakers evaluate strategy quality, team reliability, and historical performance before deciding whether to delegate collateral. They are compensated through a yield premium paid by the operator, which functions like the fee a contractor pays to obtain a surety bond. Operators that consistently perform well can access capital at lower premiums, while riskier ones must offer higher yields to attract guarantees. This dynamic mirrors real-world bonding markets, where risk pricing reflects trust and creditworthiness. In Cap, all of this happens in a decentralized and permissionless environment, but the logic remains the same. The staker premium is the cost of trust, and its level is governed by market confidence in the operator’s ability to deliver on their obligations.

Despite the structural alignment, several important differences distinguish Symbiotic guarantees from traditional surety bonds. In a typical surety arrangement, if the principal defaults, the surety covers the losses but retains the right to be indemnified by the principal. This protection is referred to as contractual indemnity from the principal. Cap introduces a similar mechanism. While stakers post collateral to guarantee operator performance, they are not forced to absorb losses without recourse. Instead, operators must, under certain conditions, repay stakers if slashing occurs. This gives delegators a right to be repaid, reducing their net exposure. The model avoids traditional insurance logic where a payout ends the process. Instead, it encodes recovery flows directly in the protocol. Enforcement happens through smart contract conditions rather than legal claims, which enables faster and trustless resolution based on predefined evidence of operator failure.

Another difference lies in the entity providing the guarantee. In traditional finance, the surety is a single centralized institution with its own balance sheet. In Symbiotic’s model, the guarantee is distributed across many independent stakers. Each holds a fractional share of the total collateral, and collectively their stake backs the operator’s activities. This decentralization introduces new advantages. Risk is spread more widely, and slashing events do not rely on a single party’s solvency. However, it also means that enforcement depends on protocol governance and precise contract design rather than on institutional capital reserves. Furthermore, Cap avoids collateral reuse across networks, which guarantees that staker funds are dedicated exclusively to Cap’s obligations. This makes the guarantees unambiguous and isolates slashing risk to within Cap’s system.

Conclusion

Symbiotic guarantees resemble surety bonds in their economic structure and incentive alignment. They enforce performance by putting third-party capital at risk and protect users from operator failures by transferring risk to stakers. The analogy is strongest in the tripartite structure of principal, guarantor, and beneficiary, as well as in the use of premiums to price risk. Where the models diverge is in enforcement, centralization, and legal recourse. Symbiotic relies on code, decentralization, and programmatic slashing. Traditional bonds rely on contracts, credit analysis, and indemnity. Cap’s approach demonstrates how legacy financial guarantees can be reengineered into a fully on-chain format through Symbiotic, featuring faster enforcement, broader participation, and greater transparency, while preserving the core economic logic that ensures the effectiveness of surety systems.

For more information about Symbiotic and Universal Staking, visit https://symbiotic.fi/.