Universal Staking is more than just restaking. Instead of merely reusing staked assets to secure multiple networks, it introduces a flexible coordination layer for sharing collateral across a wide range of use cases beyond Proof-of-Stake (PoS) implementations.

Traditional Shared Security

At its core, shared security is the alignment of incentives, either horizontally across multiple participants or vertically across layers within the same system. This foundational primitive unlocks a modular design space. Horizontally, it enables networks to tap into pooled economic security, accelerating decentralization in a capital-efficient way. Vertically, it turns existing tokens into multi-purpose assets, like using governance tokens to secure sequencing layers.

By making data around validator performance, node distribution, operator quality, and security effectiveness transparent and programmable, it reduces coordination friction and lowers the barrier to deploying decentralized infrastructure.

But shared security is just the beginning. While it allows networks to inherit trust more efficiently, it is often implemented in narrow, use-specific ways. What comes next is a broader coordination layer, one where capital can flow dynamically between networks and applications, supporting diverse forms of security, utility, and risk underwriting with customizable rules and shared infrastructure.

The Universal Staking Framework

Through engaging with hundreds of builders over the last few months and launching 14 networks on mainnet, we realized that the underlying concept of shared security can be leveraged in ways far beyond what restaking and traditional shared security infrastructure envisioned. What started as a way to coordinate stakers and networks around Proof-of-Stake security revealed a broader design space for incentive alignment and capital coordination.

Universal Staking, as developed through Symbiotic, builds on this insight. It generalizes the shared security model into a modular coordination layer that can be applied across use cases, not just for securing consensus, but also for underwriting risk, bootstrapping new protocols, and aligning incentives between diverse actors. For example, lending markets can use it to backstop bad debt, enabling stakers to opt into specific risk profiles with customizable terms. This is no longer just about securing networks, but about unlocking new forms of programmable trust between capital and applications.

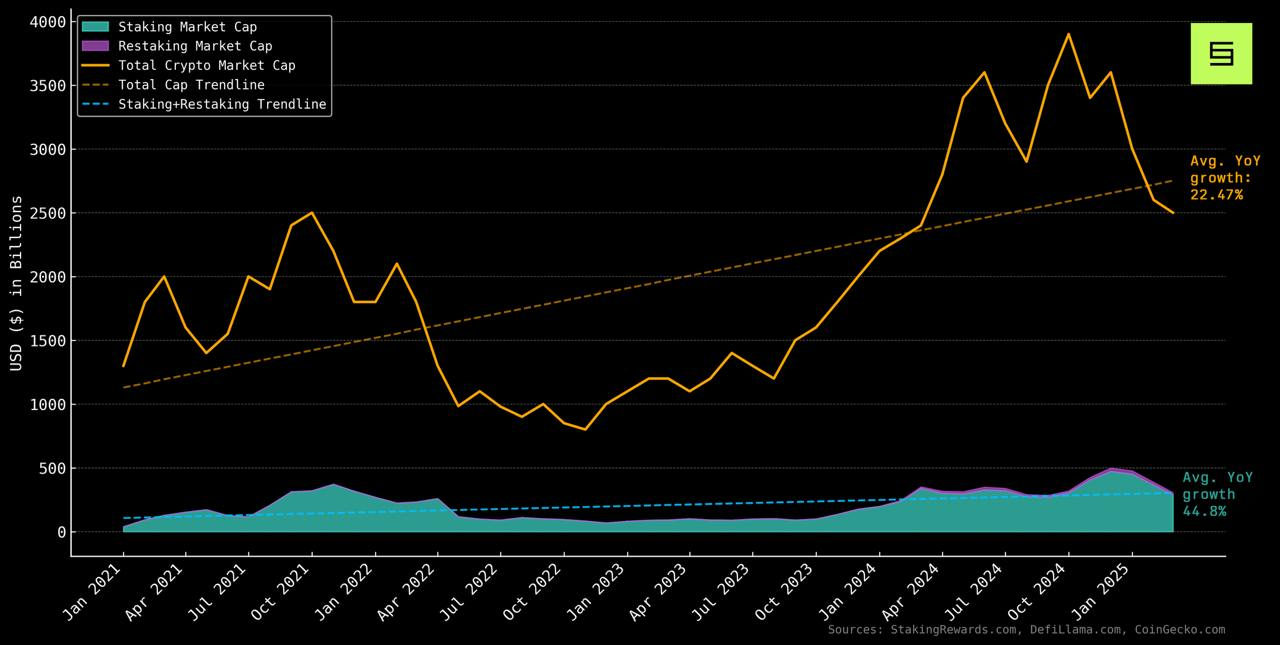

While the chart below shows that staking has outpaced total crypto market growth since 2021, it also underscores how early we still are. Symbiotic is built to push beyond traditional staking by allowing projects to bootstrap security from external assets, design modular staking systems, and apply staking to use cases like risk underwriting and insurance. The goal is not just to scale staking’s footprint, but to evolve it into a coordination layer for capital, security, and incentive alignment across the onchain economy.

Key Metrics

- Staking grew from 2.99% to 11.56% of total crypto market cap since 2021.

- Restaking emerged from 0 to nearly 1% of total crypto market cap in under 2 years.

- While crypto market cap grew 22% YoY since 2021, staking and restaking quietly doubled that at 45%.

- At the current trajectory, staking + restaking will reach 50% of crypto market cap in ~8.4 years (around early 2033).

data from DefiLlama, StakingRewards, and Coingecko

Universal Staking Use Cases

Native Staking

Native staking refers to the use of a protocol’s own token to secure and coordinate activity within its ecosystem. While traditionally tied to Proof-of-Stake consensus or governance, Universal Staking reframes native tokens as programmable trust assets, acting as flexible primitives for enabling coordination, enforcing rules, and aligning incentives across modular systems.

Expanded Utility

- Programmable Trust Layers: Native tokens are no longer limited to gas payments or voting power. They can encode slashing conditions, distribute rewards, and coordinate behaviors across trust-minimized components.

- Incentive Systems: Models like vote-escrow and revenue sharing allow protocols to design long-term alignment between users, contributors, and applications.

- Composable Security: Projects such as Hyperlane show how native staking can be combined with staking on Symbiotic to enforce custom slashing logic and strengthen inter-network security assumptions.

- Mesh Security and Cross-Ecosystem Coordination: Native tokens can participate in broader security meshes, where the same asset secures appchains, messaging layers, oracle networks, and more, all at once.

Example

Hyperlane uses HYPER for native staking to encode programmable trust logic within its modular interchain stack. Through Symbiotic, HYPER holders can stake their tokens and secure core components like ISMs. For a deeper look into how Universal Staking powers native trust models, check out our blog post on Hyperlane.

Insurance and Guarantees

Universal Staking enables programmable collateralization to underwrite risks beyond protocol security, e.g., lending, insurance, or structured financial products. Capital can be orchestrated through slashing conditions, acting as automated enforcement mechanisms.

Expanded Utility

- Bad Debt Protection: Inspired by Aave's vision for shared insurance pools, protocols can create bad debt backstops by pooling staked capital and shared economic security from across the ecosystem. DAOs, curators and lending markets can customize slashing triggers based on default conditions or liquidity thresholds.

- Other Structured Products:

- Downtime insurance for validators and node operators.

- MEV protection funds, where actors stake against misbehavior and get slashed for proven attacks.

PoS Implementations, as in Traditional Shared Security

The most familiar application of Universal Staking. It brings PoS-style security to specific infrastructure components, allowing shared security to be applied at a modular level.

Expanded Utility

- Interoperability protocols (such as bridges and messaging layers): Stakers post collateral to guarantee message correctness and transaction finality across chains. Slashing enforces honest relaying.

- Oracles: Stake is used to guarantee accuracy or uptime for price feeds and other data. Misbehavior or failure to deliver correct data can trigger slashing. This extends to MEV-resistant oracle designs and similar integrity-critical systems.

- Sequencers and rollups: Rollups increasingly rely on shared sequencer and operator sets to decentralize. Universal Staking provides a pooled security layer that helps these systems bootstrap trust assumptions without needing to launch a native token or maintain an isolated validator set.

Conclusion

Shared security introduced a powerful primitive. It allowed systems to align incentives and inherit trust without needing to bootstrap from scratch. By enabling networks to coordinate around pooled security, it lowered the capital barrier to decentralization and helped scale early rollups, appchains, and infrastructure layers.

Universal Staking is the natural next step. It does not replace shared security but expands its reach. By generalizing the concept beyond validator coordination, it applies the same principles to a broader set of use cases. This includes native staking, risk underwriting, insurance, MEV protection, and incentive design.

The result is a flexible and modular coordination layer. Capital, incentives, and enforcement can now be orchestrated across a wide range of applications. The same mechanism that once secured chains can now secure infrastructure, protocols, and entire ecosystems.

Symbiotic is the programmable layer that makes this possible. It enables builders to design staking flows, slashing conditions, and validator sets, while continuously enforcing the rules.

Universal Staking takes the core promise of shared security and evolves it into a universal building block for the next generation of crypto systems, now fully accessible through the Symbiotic framework.